A version of this article was originally published in CoreNet’s The Leader/Source Magazine. Download The Sustainable Real Estate Program Handbook .

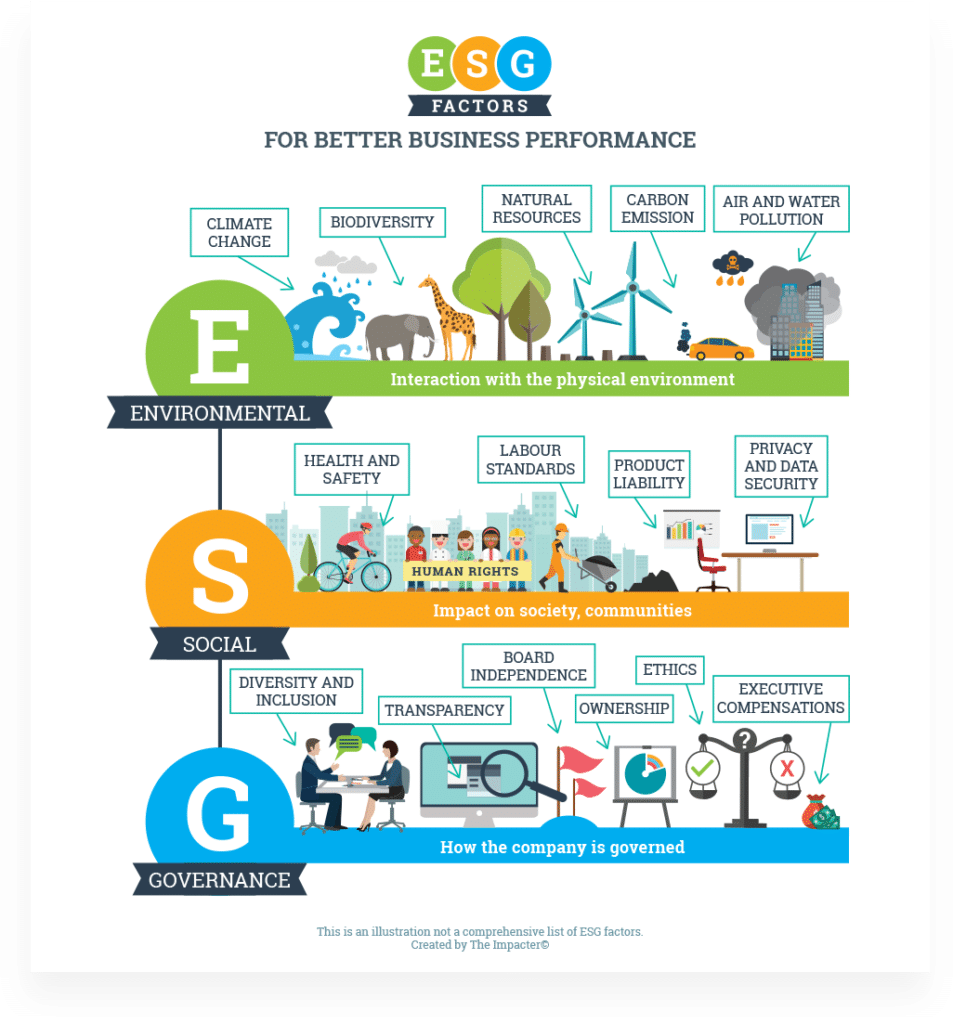

If there’s one single topic that every corporate real estate professional should have on their mind in 2021, it’s ESG. ESG encompasses the environmental, social, and governance performance of a company and has a strong correlation to the company’s financial performance and potential for long-term value creation.

Source: The Impacter

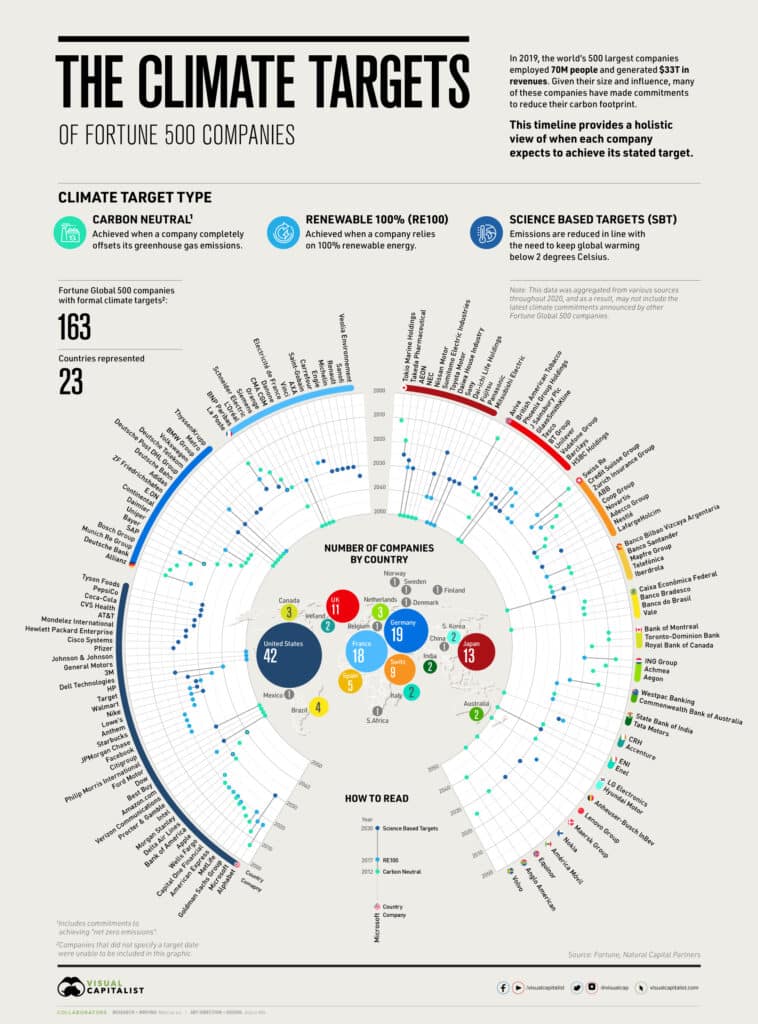

A confluence of circumstances over recent years has catapulted ESG to become the strategic business imperative for the C-suite. Global acceptance of climate science and the material risks it poses for business operations, and humanity at large, has accelerated corporate climate targets and environmental data reporting. The COVID-19 pandemic highlighted the critical need for prioritizing human health and instilling new levels of resilience into global operations. The rise of the Black Lives Matter movement catalyzed international action towards social equity and justice, and reinvigorated diversity, inclusion, and belonging in the corporate agenda.

Source: Fortune, Natural Capital Partners, Visual Capitalist

Corporations are realizing how interdependent our global challenges are, and the need to be responsive to all stakeholders—people, planet, and the economy—to responsibly manage their business, create lasting value, and avoid risks of inaction. Corporate real estate professionals hold a vital role in assessing and improving a company’s ESG performance, particularly as it gains prominence to shareholders, but need to stay focused on where CRE can have the greatest impact.

CRE’S ROLE IN ESG

So, what exactly is the role of corporate real estate in ESG?

As the expectations and opportunities for ESG impact continue to evolve, a company’s physical assets and operations—especially corporations with significant real estate portfolios domestically or globally—represent an unmatched opportunity to implement smart, highly impactful, ESG-oriented practices that can provide a multitude of short- and long-term benefits.

Optimizing these benefits is key to position the real estate portfolio as an asset that can weather economic cycles, changing climate conditions, and unforeseen circumstances, such as the extended workplace shutdowns that resulted from the COVID-19 pandemic.

For CRE professionals, opportunities for impact primarily lie in the ‘E’ and ‘S’ realms, so real estate strategy should focus on environmental and social factors. Whole-building carbon (embodied and operational) and energy are urgent focus areas of the well-established ‘E,’ followed by waste and water. We’ve also witnessed an increased focus on the ‘S,’ particularly over the past year. Improving a company’s social performance can take the form of providing benefits to employees that support physical and mental health and wellbeing, partnering with local communities and nonprofits to promote more resilient developments, and supporting workplace accessibility through inclusive design.

For corporate real estate professionals, the best place to start to maximize impact is designing and operating high-performance buildings, and portfolios at large. Embedded in the definition of ‘high-performance’ buildings are five core criteria that result in positive environmental, social, and financial impact for the business:

Source: Stok

In sum, high-performance building strategies can directly improve a company’s ESG performance by boosting environmental (e.g. carbon and energy use reduction) and social (e.g. human health and wellness) factors through the company’s real estate. The question is, how can CRE professionals effectively implement these high-performance building strategies across their portfolios to impact ESG at scale?

IMPACTING ESG AT SCALE

CRE teams can advance a company’s ESG goals at scale by ensuring the five criteria of high-performance buildings are achieved on all projects across a business’s portfolio.

To drive success, a company’s real estate program should integrate environmental and social goals, requirements, and/or guidelines into the decision-making process and throughout the lifecycle of each project. Areas to drive impact exist at site selection, design, construction, and ongoing operations of buildings across the portfolio.

While the framework, initiatives, and strategies will differ for every company, successful programs have a clear vision, a consistent framework including an Action Plan and Management Plan, and teams equipped with the skills, resources, and incentives to effectively integrate the program into their business processes and decision making.

While every program has its own evolution and scope, two phases define the process for progressing a real estate program:

#1: Development: Visioning for and planning of the program through effective stakeholder engagement and goal alignment.

#2: Management: Transition from a plan to an activated program through effective implementation and monitoring.

When creating the real estate program, it’s important to understand critical factors for success and key action steps in each phase. To identify factors for success, Stok surveyed and interviewed a focus group of leading companies that have undergone the process of integrating environmental and social factors into their real estate program. The focus group survey uncovered that stakeholder buy-in in the development phase is critical to ensure the program receives necessary resources and continued support from leadership. In the management phase, data outweighs all other factors, as it provides critical feedback to monitor and inform the effectiveness of strategies, as well as quantitative content for identifying goal achievement, reporting, and effective storytelling to relay program progress both internally and externally.

With these critical factors for success in mind, the following steps outline how organizations can develop and manage resilient, adaptable programs with clear benefits and long-term value.

DEVELOPMENT PHASE ACTION STEPS

#1: Assemble project team and support roles

The integration of champions from all major departments—including sustainability, real estate, facilities, finance, HR, and others—in a company can support stakeholder buy-in, and effective governance structures typically include a cross-departmental committee and a board-level steering committee.

#2: Assess existing programs and processes

First understand how the current project delivery process works. Then understand where and how sustainability has played a part to date to deepen alignment across the organization, identify collaboration opportunities, and capture lessons learned.

#3: Create program foundation: values, vision, purpose, and mission

This early step creates the foundation of the program and can act as a compass for decision-making down the road. It’s easy to settle for an ambiguous “why,” so to avoid an ineffective statement, tackle it in four parts: values, vision, purpose, and mission.

#4: Identify material impacts and areas of opportunity

Categories can range from water to energy, carbon, land use, community, materials, waste, or wellbeing, among others. Consider what aligns with the program’s vision, what is most important to stakeholders, and how it relates to where the company is spending money, its business model, and industry type.

#5: Benchmark impact areas

Data may be piecemeal for a single building or comprehensive across the portfolio and accessed through formal data collection platforms like Energy Star Portfolio Manager or internal tracking systems that compile facilities’ utility payments. While the accuracy and ability to benchmark performance will vary greatly based on available data, it can be insightful to informing systems that need to be put in place.

#6: Develop SMART goals

These are Specific, Measurable, Achievable, Relevant, and Time-bound. Practice essentialism when goal-setting—too many goals can distract from achieving the program’s main objective.

#7: Create an Action Plan

Start by selecting strategies within the relevant elements of portfolio development and management (site selection, design, construction, and operations). Each strategy needs an associated success or performance metric to help guide the monitoring of the program in the management phase.

MANAGEMENT PHASE ACTION STEPS

#1: Create an Implementation Plan

This should outline tactics, timeline, and roles and responsibilities to bring the Action Plan to life. When creating an Implementation Plan, consider how the timeline will affect each stakeholder group, and identify where and how sustainability and ESG efforts overlap and relate to other teams within the company.

#2: Secure program financing

It’s essential to understand the capital expenditure and operational expenditure required to implement the program’s strategies to achieve program goals. Early on, identify and sync with existing budget cycles and develop a budget that accounts for any changes that will take place in response to program implementation.

#3: Create tools and resources for implementation

Create a training program and tools for implementation to ensure all stakeholders are informed and engaged with the program. Without this critical step to substantively engage the team, programs run the risk of inefficiency and inaccuracy if they are not managed as intended.

#4: Initiate program rollout

Every program needs to start somewhere—this may be initiated by a few pilot projects, implementing a phased approach strategy by strategy, or rolling out a full program across the entire portfolio. To determine the most appropriate approach, review the budget that was established, assess overall feasibility of integration given portfolio size and pipeline, and consider project team engagement and bandwidth.

#5: Measure success and monitor feedback loops

Create feedback loops to regularly receive input on the program’s performance and respond in real time through program refinements. These can include regular reporting on program progress, technology platforms reporting real time performance, and recurring meetings between cross-functional partners to ensure feedback is provided.

#6: Communicate and advocate

Once the program is up and running, continually celebrate those involved and the progress achieved—this keeps key stakeholders committed to its successes and determined to improve its shortcomings. Follow up on easy wins and report digestible yet meaningful program statistics via uniform reports, and connect it to how the program is supporting broader company efforts. Externally, share program progress based on identified reporting requirements.

#7: Iterate and innovate program rollout

Identify what the process for iterations and innovations for program rollout are, as well as the cadence and stakeholders involved. By integrating lessons learned from ongoing feedback, the program will evolve on a regular basis, supporting its relevance, resiliency, and ability to deliver on corporate ESG goals.

IN CLOSING

CRE professionals have an immediate opportunity to help improve their company’s ESG performance through the design and operation of high-performance buildings across the real estate portfolio. By creating and implementing a real estate program focused on environmental and social factors, CRE teams will ensure that each project and the entire company portfolio will achieve high-performance goals. Beyond improving a company’s ESG performance, a real estate program can increase real estate asset value, lower operating costs, and improve financial performance while enhancing factors of employee retention, productivity, and wellbeing.

Stok launched The Sustainable Real Estate Program Handbook to provide comprehensive guidance on the development and management of environmental and social factors for the corporate real estate professional. Download the handbook .