In Greenbuild’s recent webinar on “Integrating Climate Risk into Your ESG Program: How to Tackle Portfolio Assessment, Risk Mitigation, and TCFD Reporting,” I had the pleasure of moderating a panel of climate experts in the commercial real estate industry as we dove into the climate toolbox to review best practices for developing and integrating a comprehensive climate change resilience program into an organization’s ESG program, overall business, and risk strategy. ICYMI, here’s a recap!

FIRST, WHY ADDRESS CLIMATE CHANGE?

The economic costs of climate change are staggering. Climate-influenced weather events caused $165B of economic damage in the U.S. in 2022. This number is only expected to grow as floods, heat waves, droughts, and wildfires are two to four times more frequent since 1980.

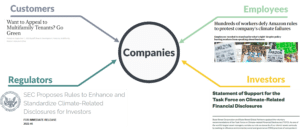

Against this backdrop, companies are facing increased pressure from all sides to address climate change:

-

- Customers – tenants are demanding more efficient buildings

- Regulators – local, regional, federal, and international regulations regarding climate disclosure are on the rise, like the SEC’s proposed climate rules

- Employees – workers are holding their employers accountable to climate commitments

- Investors – there’s a growing expectation for companies to report out on how they’re managing to climate risks and opportunities, and more investors are making and upholding climate commitments

With these considerations, failure to develop a comprehensive resilience program that’s integrated into the overall business strategy can come at a high cost, endangering building occupants, stranding assets, and resulting in noncompliance with mandatory laws or reporting schemes.

With these considerations, failure to develop a comprehensive resilience program that’s integrated into the overall business strategy can come at a high cost, endangering building occupants, stranding assets, and resulting in noncompliance with mandatory laws or reporting schemes.

WHAT ARE WE TALKING ABOUT WHEN WE TALK ABOUT CLIMATE RISK?

So, the need to address risk is clear. But what risk are we talking about? Risks related to climate change are categorized into two types: transition risks and physical risks:

-

- Transition risks are the economic impacts that result from a shift to a lower-carbon economy and the resulting changes in regulatory standards and market trends.

- Physical risks are the impacts of adverse weather events, including extreme weather events, sea-level rise, and changing weather patterns.

Some of the consequences of risk exposure include economic losses, inaccurate valuation, and stranded assets. Thus, identifying, assessing, and managing climate risk is crucial.

WHERE SHOULD A COMPANY START?

For owners, operators, and developers looking for streamlined guidance on addressing climate risk, there’s good news: all roads lead to alignment with the Task Force on Climate-Related Financial Disclosures (TCFD). Created by the Financial Stability Board (FSB), TCFD helps companies meet the demands of regulators, investors, employees, and customers while also helping companies streamline the integration of their climate program into their overall ESG program. The framework is designed to help companies demonstrate how they’re managing climate-related risks and opportunities.

Be warned, while TCFD may sound like the silver bullet solution, as with most things, one size does not fit all. Climate change will affect different types of firms in different ways, so TCFD is designed to reflect the diverse nature of business models and the geographies in which they operate in. These disclosure recommendations are structured around four key areas that represent core elements of how companies operate: governance, strategy, risk management, and metrics and targets. Together, these elements provide a clear picture as to how a company is or isn’t identifying, assessing, and managing climate risks across their portfolio.

With this framework as a foundation, let’s delve into how to start tackling climate risk within a CRE portfolio, starting with transition risk.

TRANSITION RISK

In real estate, we’re always considering the future: rental rates, occupancy, operating expenses, and the like. Now, with heightening net zero expectations, companies need to add carbon emissions to the list.

Hewson Baltzell, President & COO at Helios Exchange, shared how – through a partnership with Moody’s – they approach transition risk and turn data into actionable plans for energy efficiency measures (EEMs) at the asset level. The approach combines advanced progressive modeling tools with a smart database of EEMs to present clear, prioritized measures to adopt. Together, they answer the questions:

-

- Where is your portfolio now?

- Where does it need to go?

- How can it get there, and what will it cost?

- What energy savings from these measures can mitigate this cost?

- What other scenarios should be considered?

Starting with basic property information, the Helios model uses weather station data, climate zone data, energy prices, and grid data, all while aligning to international building science standards (e.g., ASHRAE, ASTM), to create a digital twin of each building to determine the current energy performance and carbon emissions of the portfolio.

This current performance is then mapped against different decarbonization pathways, and the Helios model assesses a library of 37 EEMs (e.g., heating, cooling, lighting) to estimate cost, energy savings, and emissions reductions and then develop scenarios. These are rolled up into a summary report showing overall performance, plus the cost of meeting decarbonization targets, energy savings, and potential stranding dates.

How we manage transitional risks today will play a big role in the physical risks we are likely to face in the future.

PHYSICAL RISK

Climate impacts are already being felt across the CRE value chain. As Lindsay Ross, Director of Client Service at Moody’s ESG Solutions pressed, it’s crucial for companies to integrate physical climate risk into their decision making to understand the context surrounding a single asset, inform due diligence, and identify opportunities to engage with building owners, managers, and communities around building resilience.

For physical risk, a unified risk assessment can address how much damage and business disruption an asset faces, as well as what it will cost. There are three parts to a unified risk assessment, as captured in Moody’s Climate on Demand Pro tool:

-

- Hazard scores answer “how likely is it that a location experiences high winds, flood water, fire, etc.?”

- Damage values and Impact scores answer “what level of loss or disruption should be expected at a location or for a portfolio?”

Together, this creates a unified risk assessment, which quantifies risk into a dollar value that companies can use for due diligence and prioritizing assets for risk mitigation measures. Once priority assets are identified from desktop assessments, Helena Ariza, ESG Program Manager & Climate Resiliency Lead for Nova Group, GBC explained, companies can dig in deeper with a site-level assessment to uncover actionable mitigation plans at the asset level.

The goal of a site-level climate resilience assessment is to anticipate and prepare the asset to respond to climate hazard events, limiting negative impact and business interruption that these events can cause and making assets more resilient. Nova Group applies a three-part methodology for climate resilience assessments:

-

- Identify climate hazards that can affect the asset, which often fall into the following major hazard groups: flooding, drought, wind, wildfire, extreme temperature, and geologic phenomenon. Gather information around these hazards, including climate models, natural risk hazard data, and timeframes.

- Develop a resilience assessment that outlines the action and impact of identified climate hazards on the subject property.

- Provide recommendations for resilience measures at each property. These can fall into two core categories: mitigation (actions that increase the climate resiliency of the property and reduce risk) and remediation (actions that might be needed in case of a climate event at the property).

SOME FINAL REMINDERS

There’s a lot to be done in the realm of mitigating climate risk for CRE. A few helpful reminders to ground your efforts moving forward:

-

- A successful climate program starts with a commitment from the top. Leadership buy-in is essential for making sure that the board understands the need for proper climate risk management, incorporating climate considerations into the overall business strategy, and understanding appetite for climate risk. If you’re just getting started, a great first step is to develop a climate journey workshop or training to create a shared understanding and common language at the top and across the organization. The workshop is a valuable way to build the foundation needed for developing metrics and targets, risk management processes, and strategies for continuous improvement, achieving targets, and communicating progress.

- You don’t have to (and probably shouldn’t) do it alone. An integrated team of climate experts and solutions can help you uncover actionable insights that can help mitigate risks. Stok is here and can support the holistic ESG and climate action strategy development and integration across the portfolio and also support reporting efforts such as TCFD. Reach out to our team to discuss your portfolio.

- Don’t let perfect be the enemy of good enough. Align to TCFD! The climate journey is an iterative process and the TCFD framework provides the roadmap. The framework is your best friend for understanding and strategically mitigating climate risk. The TCFD website provides many free resources such as workshops in a box, example disclosures, and a knowledge hub.