California Senate Bill 261 (SB 261), also known as the “Climate-Related Financial Risk Act,” was signed into law in October 2023, bringing the state’s ambitious Climate Accountability Package—encompassing SB 253 and SB 261—to life.

Here we dive into SB 261, presenting the highlights of the bill, who it impacts, and what organizations can do to prepare for it.

WHAT DOES SB 261 REQUIRE?

The Climate-Related Financial Risk Act (SB 261) applies to both public and private companies that operate in California with annual revenues exceeding $500 million. After undergoing amendments, the final law mandates climate-related financial risk reports every two years.

SB 261 requires organizations to prepare a report that includes climate-related financial risks in alignment with Task Force on Climate-related Financial Disclosures (TCFD) or International Financial Reporting Standards Climate Related Disclosures IFRS S2 standards, as well as activities taken to reduce climate-related financial risk. Companies can use either TCFD or IFRS S2 for disclosure. Both frameworks are similar, with slight differences.

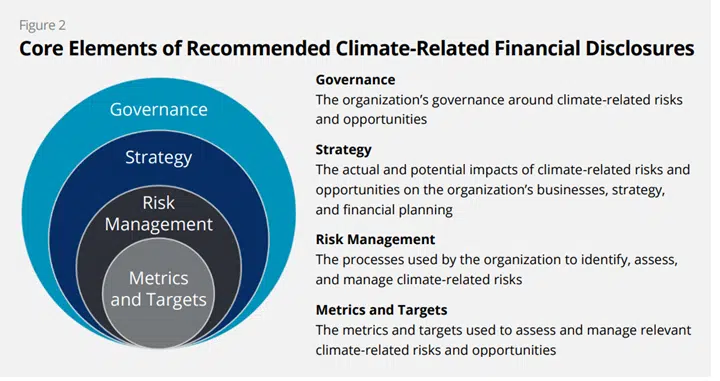

Both frameworks have four core elements of recommended climate-related financial disclosure: governance, strategy, risk management, and metrics and targets.

Source: Task Force on Climate-related Financial Disclosures

Within both TCFD and IFRS 2, disclosure of both physical and transition risks are required, as well as climate-related opportunities.

-

- Transition risks are the risks associated with transitioning to a low-carbon economy. They can include policy and legal risks, technology risk, market risk, and reputation risk.

- Physical risks are the result of a physical climate event and its impact on organizations. These can include both acute and chronic risks.

- Climate-related opportunities are results from mitigation efforts that produce a positive effect on the organization. A common example of a climate-related opportunity is cost savings from energy efficiency upgrades.

Starting January 1, 2026, companies are required to report their climate-related financial risks publicly on their website and provide a URL to their report on CARB. Companies will then be required to report on these risks every two years.

WHAT CAN I DO TO PREPARE?

SB 261 boldly places climate risk alongside traditional business risk assessments. With thousands of organizations now needing to disclose their climate-related financial risks, companies will need to understand their current climate risks as well as the financial implication and likelihood of the risks occurring.

We recommend that companies:

-

- Develop a governance structure for climate risk that aligns with current business risk practices.

- Identify all climate-related risks and opportunities. This step can be done in-house, utilizing a climate risk consultant like Stok, and/or engaging with a software consultant to analyze physical and transition climate risks facing your business.

- Develop criteria for assessing the financial impact and likelihood of these risks under different scenario analyses.

- Monitor upcoming developments with CA SB 261.

Wherever you are on your climate journey, the Stok team is here to help you prepare for disclosures and understand the upcoming regulatory requirements of CA SB 261. Reach out to discuss with our climate risk experts.