For real estate companies reporting under IFRS S2, California SB 261, or Canada’s federal climate risk disclosure requirements, climate risk has moved well beyond a sustainability issue. It is now a core financial risk, affecting asset values, credit exposure, insurance availability, and investor confidence.

Heads of Governance and Risk, Finance, Sustainability, and Operations are now challenged to assess climate risk in a way that satisfies regulators, meets investor expectations, and supports better business decisions. Many organizations are turning to climate risk software to meet these needs. By understanding where financial value is created and how different stakeholders justify return on investment, organizations can move beyond compliance and begin using climate risk software as a foundation for more informed risk and capital planning over time.

In this two-parter, we break down:

-

- Part 1: How climate risk software creates business value for real estate stakeholders.

- Part 2: What to look for when evaluating climate risk software for long-term fit.

WHAT IS CLIMATE RISK SOFTWARE?

Climate risk software is used to inform decisions about capital allocation, insurance strategy, asset valuation, and portfolio exposure under future climate conditions.

At a high level, they typically provide:

-

- Hazard exposure (e.g., heat, flooding, wildfire, storms, sea level rise, etc.)

- Damage and loss projections

- Risk scores and financial impact metrics (e.g., value at risk, VaR)

- Transition risk metrics (e.g., carbon price impacts, energy demand, retrofit costs)

- Portfolio-level insights to support disclosure, risk management, and strategy

For real estate companies, the value lies not just in translating climate science into decision-relevant financial and operational insights, but also in creating a consistent, defensible set of assumptions that can be reused across reporting, finance, risk, and investment decisions.

WHY CLIMATE RISK IS A GROWING FINANCIAL ISSUE FOR REAL ESTATE

Across the real estate ecosystem—lenders, owners, operators, and tenants—climate-related impacts are becoming more frequent and more costly.

Organizations are already seeing:

-

- Higher operating costs driven by extreme heat and weather volatility.

- Increased capital expenditures to repair or harden assets.

- Revenue losses from business interruption during climate events.

- Insurance premiums rising sharply (or coverage becoming unavailable) in high-risk locations.

At the same time, investors and regulators are asking more detailed questions about how climate risks are identified, quantified, and managed over time, not just disclosed.

WHEN TO USE CLIMATE RISK SOFTWARE INSTEAD OF PUBLIC DATA SOURCES

Public tools and datasets can be useful starting points, but they have clear limitations when used for financial decision-making.

How climate risk software differs:

-

- Forward-looking analysis rather than historical snapshots. Most public sources rely heavily on historical data. Climate risk software models future climate scenarios using the latest climate science, allowing organizations to assess how risk may evolve over time.

- More complete and regularly updated datasets. Many public datasets are updated infrequently. Climate risk software providers typically update models and datasets more regularly to reflect new science and data.

- Financial impact and value at risk (VaR) metrics. Unlike most public tools, climate risk software translates physical and transition risks into estimated financial impacts, supporting credit risk assessment, asset valuation, insurance planning, and construction and capital budget development.

- Greater depth than public tools alone, including in Canada. While Canada offers a range of high-quality public climate tools used by municipalities and regulators, these resources generally do not provide asset-level financial impact modeling needed for lender, investor, or portfolio risk analysis.

- Alignment with disclosure and reporting frameworks. Climate risk software outputs are often structured to support reporting under frameworks such as IFRS S2 and SB 261.

For organizations managing complex portfolios, these capabilities reduce manual analysis and improve consistency and confidence across reporting and decision-making.

THE BUSINESS CASE FOR CLIMATE RISK SCENARIO ANALYSIS

Whether your company is conducting climate risk scenario analysis to comply with regulations or voluntarily for financial and operational insights, this investment can create a shared, data-driven foundation for decisions across the organization.

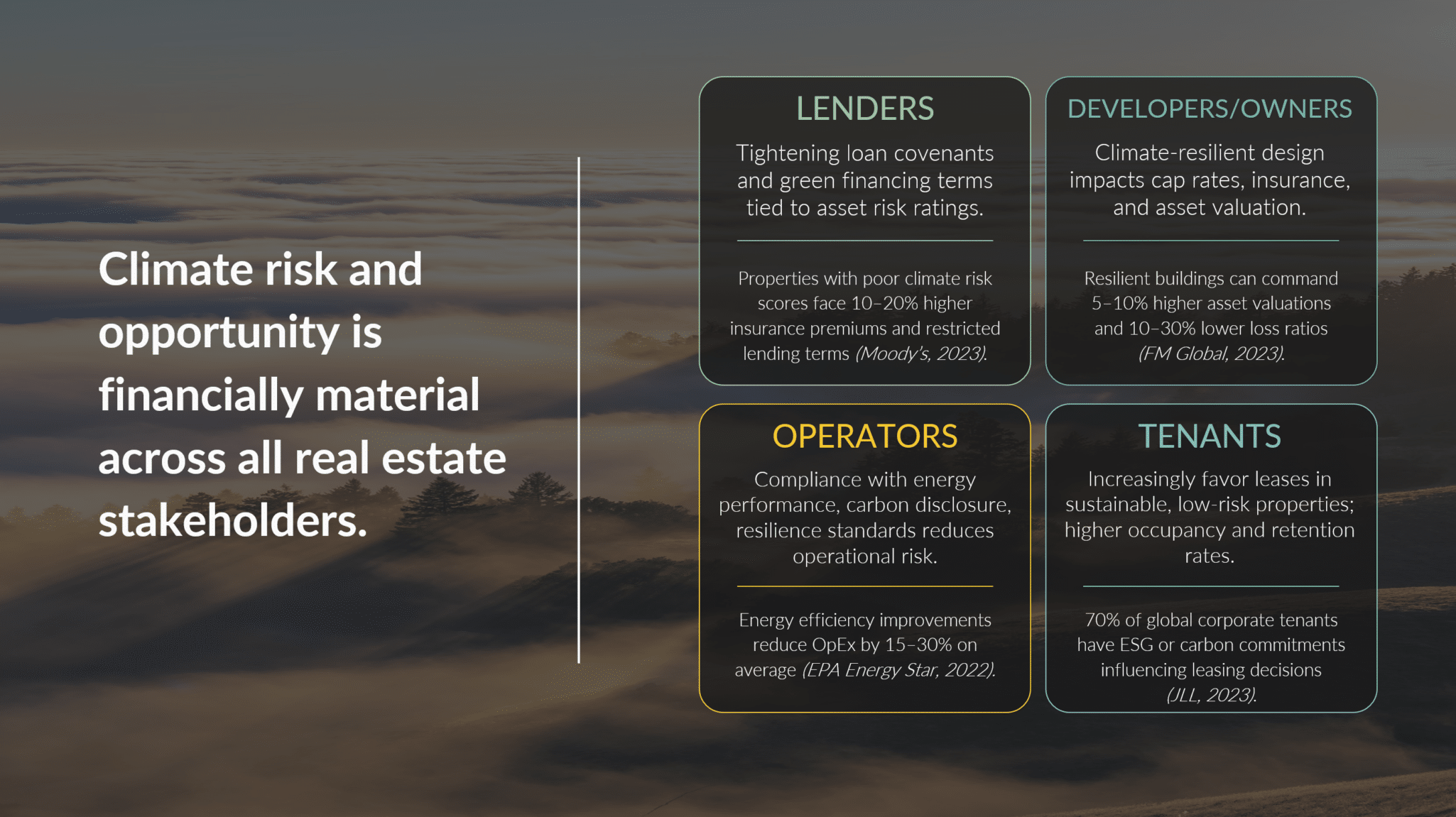

Climate risk is financially material across stakeholders:

-

- Lenders are tightening loan requirements.

- Developers and owners are navigating a widening array of building performance standards as well as increasing insurance premiums (if not available) and shrinking construction and capital budgets.

- Operators are managing to rising energy costs as well as blackouts, brownouts, and other operational disruptions.

- Tenants are searching for low-risk, high-performance properties that align with their own sustainability and climate strategies and operational continuity.

As climate risk data begins to inform core processes, organizations can move from reactive compliance to more proactive risk management.

As climate risk data begins to inform core processes, organizations can move from reactive compliance to more proactive risk management.

HOW ORGANIZATIONS ARE USING CLIMATE RISK SOFTWARE IN PRACTICE

Across the real estate sector, we’ve seen climate risk software support tangible business outcomes.

Lenders

A multifamily mortgage lender initially conducted scenario analysis to comply with California SB 261. They’re now exploring how the results can help them place adequate insurance coverage for borrowers and reduce the financial exposure of having concentrations of loans in high-risk areas.

Developers and owners

A long-term hold real estate owner used compliance as a launch point for their organization-wide climate risk and resilience strategy. This has safeguarded asset value, maintained adequate insurance, and improved long-term asset efficiency and market competitiveness.

Operators

A multifamily owner-operator began reporting on climate risk strategy to GRESB and was motivated to go deeper into the financial impacts of climate risk. They’re now using scenario analysis at the asset level during acquisitions to negotiate a purchase price that considers the budget needed for asset resilience measures, as well as at the portfolio level to prioritize capital expenditures that reduce damage during climate-related extreme weather events.

Tenants

A Fortune 500 global technology company has reported physical risk to CDP at the portfolio level but wanted to identify specific physical adaptation and mitigation measures to increase occupant safety and health at a large campus site. Not only did they enhance occupant wellbeing, but they were able to quantify the reduction in liability to the business and to business interruptions.

WHAT’S NEXT: GETTING MORE VALUE FROM YOUR CLIMATE RISK INVESTMENT

Once you’re managing to a budget, two factors can help you get the most value out of your investment in climate risk tools:

-

- #1: Choosing climate risk software that aligns with your regulatory, financial, and portfolio needs.

- #2: Integrating climate scenario analysis results into risk management, investment, and strategic decision-making to drive long-term value and future-proof your assets.

In Part 2, we walk through how to evaluate climate risk software providers.

Ready to choose your provider and get the most out of your investment with an integrated approach? Stok has reviewed 15 providers and conducted in-depth technical interviews with 10 leading platforms. Reach out to learn more or check out Part 2.