2022 has already proven to be an exciting year in the carbon space, and we’re seeing constant evolution in companies’ need and ambition to meet increasingly stringent targets aligned with the latest climate science. To stay on top of all things carbon, here are five key trends that are shaping the market.

#1: COMPANIES ARE FACING PRESSURE FROM INVESTORS AND REGULATORS TO ADDRESS CLIMATE CHANGE

While companies facing pressure from customers and employees to act on climate has gained traction in recent years, pressure from investors and regulators is relatively new and on the rise. Companies are now seeing increased standards and requirements around disclosure of climate related information and specifically, around the financial impacts of climate change risks and opportunities. Investors such as commercial banks and private equity are for the first time beginning to measure and report on the “financed emissions” of their investments. As this happens, companies accessing capital through these institutions will be asked to provide supporting climate metrics such as greenhouse gas (GHG) impact and emissions reduction targets. Given that portfolio emissions of global financial institutions are on average 700 times larger than direct emissions, this move is poised for major impact. On the regulatory side, new rules proposed by the SEC on March 21 would require registrants to report GHG emissions and climate related risks and financial metrics within registration statements and filings such as 10-Ks.

#2: THE MARKET IS EVOLVING FROM DISCLOSURE ALONE TOWARD PERFORMANCE AND RISK MANAGEMENT

We’re also seeing an evolution of the market away from disclosure toward performance and risk management. Not long ago, disclosing a few climate metrics in an annual report used to be enough to meet market demand. Today, “checking the box” is no longer sufficient; organizations are increasingly expected to disclose third party-assured climate metrics that reflect current climate impacts as well as progress toward corporate targets and commitments, and detailed plans to achieve them.

Organizations such as the Task Force on Climate-Related Financial Disclosures (TCFD), have emphasized the need to assess the impacts of climate change on the financial aspects of a business. Doing so requires organizations to evaluate the physical and transitional risks and opportunities posed by climate change through exercises such as scenario modeling and stress testing. TCFD guidance has since been adopted by several reporting frameworks, such as CDP and GRESB, as well as by regulatory efforts, such as the EU Sustainable Finance Disclosure Regulation (SFDR) and the U.S. SEC proposed climate rules.

#3: ACCOUNTING FOR VALUE CHAIN EMISSIONS IS A MUST

Demand for Scope 3 accounting from investors, customers, and regulators has grown rapidly in recent years, and for good reason: for many organizations, value chain emissions represent the greatest climate impacts and risks to business continuity. Today, organizations are expected to account for all operational and value chain (Scope 1, 2, and 3) impacts. Scope 3, or value chain, impacts include the emissions generated from the upstream and downstream activities of an organization; essentially, everything outside of operational energy use. For the average company, supply chain emissions are around 11.4 times greater than direct emissions. For real estate companies, Scope 3 impacts are concentrated in building materials—so-called embodied carbon and end of life treatment—and in tenant energy use.

#4: SUPPLY CHAIN REQUIREMENTS ARE ON THE RISE

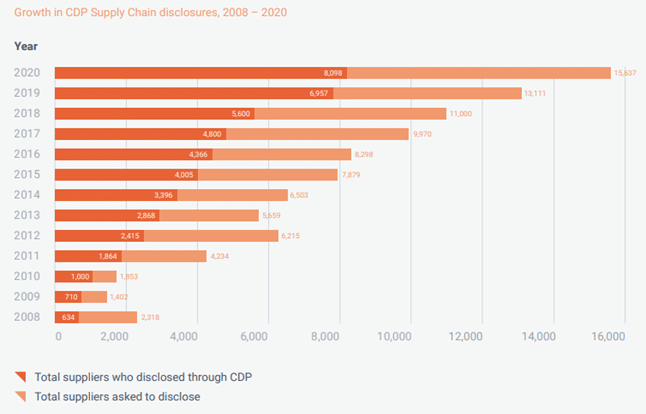

As organizations face increased pressure to account for their Scope 3 impacts, we’re witnessing a growth in partnerships and engagement with peers, suppliers, and investors as organizations explore how to achieve deep emissions reductions within their value chains.

CDP, a global reporting standard for climate, water, waste, and land use, has witnessed rapid expansion of its supply chain disclosure platform in recent years. Investors and supply chain managers may use CDP to request climate information from their holdings and suppliers. CDP’s standardized reporting removes the burden of manual data collection while permitting comparative evaluation of performance between companies and against peers. Each year, more investors and supply chain managers are requesting climate disclosure through CDP; each year, we see an increasing number of holding companies and suppliers respond.

#5: THE AMBITION LEVEL AND RIGOR OF REDUCTION TARGETS IS INCREASING

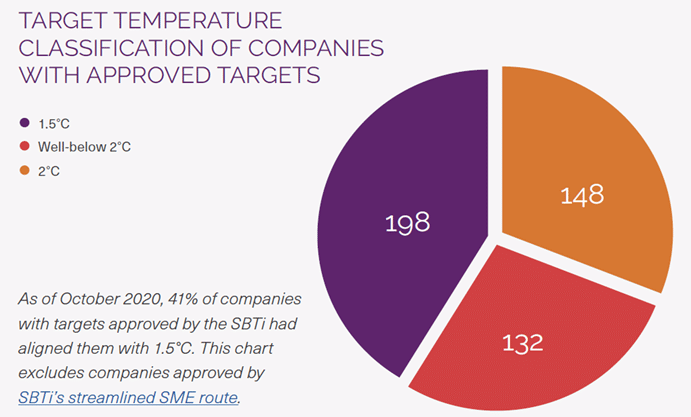

As a result of increased expectations around climate action, corporate target-setting through the Science-Based Targets initiative (SBTi) has skyrocketed in recent years. Evolving with the latest climate science published by organizations such as the Intergovernmental Panel on Climate Change (IPCC), corporate emissions reduction targets (including Scopes 1, 2, and 3) that align with the 1.5-degree pathway are no longer considered ambitious—they’re industry standard. Likewise, a target aligning with a 2-degree increase in global average temperatures is no longer seen as sufficient to avoid the worst impacts of climate change and is perceived as less credible within the market. The Science Based Targets initiative no longer approves 2-degree targets.

At Stok, we remain excited by the rapid evolution occurring in the carbon space. Our objective is to support clients not just in understanding and responding to current market expectations and regulatory pressures, but in also positioning their businesses and assets for the future. A changing climate presents substantial risks but also meaningful opportunities for material environmental and financial impact. If you’re wondering how your organization can get started or take your decarbonization efforts to the next level, reach out to our team. We look forward to speaking with you soon.