So, you’re looking to buy carbon credits, but don’t know where to start? You’re not alone.

Carbon credits as an emissions mitigation tool and investment opportunity are of increasing interest to the corporate world. The voluntary market for credits as well as the quality and application of credits themselves remains nuanced and challenging given the lack of existing regulation, liquidity, and established guidance and best practices.

In this two-part FAQ, we break down some of the most common carbon credit questions to help enable organizations to effectively explore carbon markets in pursuit of decarbonization goals. Part 1 covers the basics: what carbon credits are and why they matter. Part 2 journeys into action: how to strategically identify credible and cost-effective carbon credits, and when to invest in them.

Let’s dive in!

WHAT ARE CARBON CREDITS?

Carbon credits are a financial instrument and climate mitigation mechanism that represents one metric ton of carbon dioxide or carbon dioxide equivalent (MTCO2e) that has been avoided, reduced, or removed from the atmosphere.

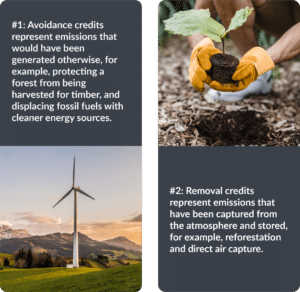

There are two types of credits: avoidance and removal credits.

WHAT ARE CARBON MARKETS?

Credits are sold within voluntary carbon markets (VCMs) and compliance carbon markets (CCMs). VCMs refer to unregulated marketplaces where credits are traded on a voluntary basis. This is opposed to compliance carbon markets (CCMs), such as the EU Emissions Trading Scheme (ETS), and California State Cap-and-Trade Program, where credits (or permits) are based on allowances and action is jurisdictionally regulated.

Despite the recent rise in the profile of VCMs, their aggregated market value and daily trading is fractional compared to that of the more established CCMs. Nevertheless, the Taskforce on Scaling Voluntary Carbon Markets (TSVCM) estimates that the market for credits on VCMs could be worth more than $50 billion in 2030.

WHAT ROLE DO CARBON CREDITS PLAY IN NET ZERO?

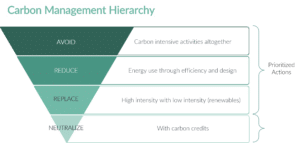

Within the context of net zero, carbon credits can be thought of as the “net,” neutralizing the residual emissions that cannot be avoided; however, this is not to say that companies should wait until their target year to purchase credits. Immediate investments in the drawdown of carbon from the atmosphere are critical to mitigate the worst impacts of climate change. While it’s best for companies to prioritize avoidance (no generation), reduction (through efficiency and design), and replacement (through lower-carbon energy sources), carbon credits can be seen as a complementary mitigation strategy near- and long-term.

Now that you have the carbon credits basics down, learn to put this knowledge into practice with our Carbon Credits FAQ Part 2: How to Get Started and reach out to discuss carbon credits with Stok’s experts.