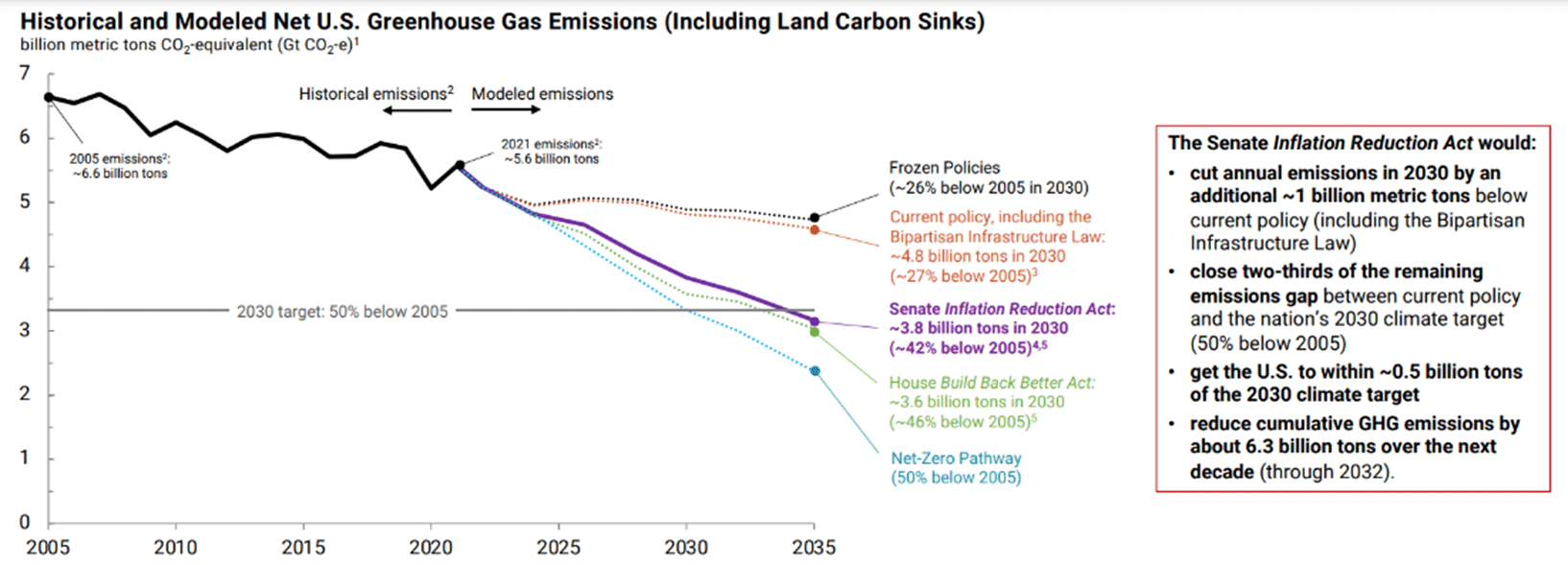

It’s an exciting time for climate legislation! The Inflation Reduction Act (IRA) was signed into law on August 16, 2022, marking a significant step as the largest climate investment in U.S. history. The IRA unlocks $369 billion of federal funding for energy and climate provisions and sets the U.S. on the path to reduce greenhouse gas emissions by 40% below 2005 levels by 2030. Climate provisions focus on lowering consumer energy costs, supporting energy security and investment in clean energy manufacturing, decarbonizing the economy, investing in communities and environmental justice, and advancing resilience efforts in rural communities and coastal habitats.

“The potential impact of this bill cannot be overstated. It sets a new course for industry and for the country as a whole, bringing much needed momentum and optimism to our collective climate action efforts.”

—Colette Crouse, Director of Carbon Services, Stok

The bill will have direct impacts on commercial real estate and construction, largely characterized by the extension and expansion of tax credits. This includes embodied carbon through low-carbon material support, energy-efficient commercial buildings, rebates for energy-saving projects, expanded grants to state and local governments for building energy codes, incentives for clean electricity and electric vehicles, and more. Stok’s work with real estate developers and operators bears out the importance of tax credits—they are often the factor that makes or breaks a project. So alongside simple payback analysis, we incorporate regulatory incentives such as tax credits throughout our energy models and life cycle cost analyses reporting.

Source: https://repeatproject.org/docs/REPEAT_IRA_Prelminary_Report_2022-08-04.pdf

With ample opportunity to unlock, here is our quick IRA guide for those working in commercial real estate:

#1: EMBODIED CARBON

- $250M of funding to develop and standardize Environmental Product Declarations (EPD) for construction materials with grants and technical assistance from manufacturers

- $100M to identify and label low-carbon materials and products for federally funded transportation and building products

#2: COMMERCIAL BUILDINGS

- Tax deductions for energy efficient commercial buildings, including expanded incentive for 10 years by increasing $1.80 per square foot to a sliding scale of $2.50- $5.00 per square foot, as well as new eligibility for Real Estate Investment Trusts (REITs) to access deductions

- $1B for grants helping state and local governments adopt and implement building energy codes, split into $330M for meeting 2021 IECC or ANSI/ASHRAE/IED 90.1-2019 and $760M for meeting or exceeding the zero energy provisions in the 2021 IECC or equivalent stretch code

#3: LARGE MULTIFAMILY RESIDENTIAL BUILDINGS

- Homebuilder Tax Credit: Large multifamily residential buildings will be eligible for credits of $2,500 per unit for meeting ENERGY STAR or $5,000 per unit for meeting DOE zero energy ready. Expanded from a past law that limited multifamily buildings to three stories or less, the updates would make this credit accessible to all multifamily buildings at $2,500/$5,000 per unit with established wage requirements.

- Residential Clean Energy Credit: 30% credit for eligible expenditures for onsite residential solar electric, solar water heating, fuel cell, small wind energy, and geothermal heat pumps through the end of 2032. This existing credit expands eligible properties to include battery storage. The credit will reduce to 26% in 2033 and 22% in 2034 and will expire at the end of 2034.

#4: PUBLIC BUILDINGS

- $250M to the U.S. General Services Administration (GSA) from FY22 to 2031 to convert federal buildings to high-performance buildings

- $975M to the GSA to be spent through 2026 on emerging and sustainable technologies, which could include funding GSA’s Green Proving Ground program focused on driving down operational costs in federal builds through the deployment of new technologies

#5: CLEAN ENERGY

- Expanded and extended Investment Tax Credit (ITC) and Production Tax Credit (PTC) for renewable energy projects. These incentives will be replaced for construction projects starting after 2024 by new technology-neutral incentives focused on emissions reduction. The $10B investment tax credit is meant to fund the construction of clean technology manufacturing facilities, which includes the production of electric vehicles, solar panels, wind turbines, and more.

- $40B available until 2026 for loans from DOE Loan Programs Office, aimed to support commercial implementation of innovative clean energy technologies

- Electric vehicle (EV) incentives, including expanding the 30d clean vehicle tax incentive through 2032 for a $7,500 tax credit on purchases of qualifying clean vehicles, as well as a new tax credit of up to $4,000 for qualifying used clean commercial vehicles (up to 30% of sales price) and a new tax credit for clean commercial vehicles

#6: GHG REDUCTION FUND

- $11.97B for competitive grants for projects that reduce or avoid greenhouse gas emissions

While the bill is less robust than the Build Back Better legislation, it is a huge step forward and an opportunity to leverage new resources to reach target emissions deadlines while improving building performance and energy efficiency. So, what does this mean for you?

“The expanded tax credits in the IRA make investments in high-performance, sustainable buildings even more cost effective. As businesses race to stand out to ESG-focused investors and employees, this is the time to embed sustainability in real estate portfolios.“

–Matt Macko, Founder, Stok

The Inflation Reduction Act only includes federal money, however there is even more additional funding from the state, local, and utility level. There’s an unprecedented increase of funding available for professionals in commercial real estate that are looking to reduce energy costs. Reach out to Stok for more details on how the Inflation Reduction Act can positively impact your business.

Hero image courtesy of County of San Diego (County Operations Center)