Stok recently attended the IMN ESG and Decarbonizing Real Estate Forum, where real estate leaders shared insights on the top environmental, social, and governance (ESG) trends shaping the industry. In a shifting regulatory and political landscape, it was energizing to engage with experts committed to advancing sustainability.

While terminology may be evolving, one thing remains clear: the real estate sector continues to prioritize meaningful action, with decarbonization at the forefront. Here we share insights gathered from ESG, sustainability strategy, and real estate leaders on top trends in 2025.

#1: RENEWED FOCUS ON TANGIBLE ACTIONS TO DECARBONIZE ASSETS

With a strong emphasis on moving the discussion to implementation, real estate leaders are focusing on tangible strategies that drive decarbonization now. Building owners and operators are implementing practical upgrades, including:

-

- Building envelope improvements by adding insulation, sealing leaks, upgrading windows, and installing exterior shades. These measures reduce energy loss and improve overall efficiency.

- HVAC optimization and smart boiler controls, which can result in significant savings at relatively low cost, according to several real estate firms in attendance.

- Additional efficiency measures, such as lighting upgrades, leak detection, water rebates, and thermostat replacements, which further help buildings operate at peak efficiency.

Comprehensive measurement and verification then confirms performance of these upgrades in operations while maintenance programs and staff training sustain efficiency over time.

#2: ESG AND SUSTAINABILITY STRATEGY AS A VALUE DRIVER IN REAL ESTATE

ESG and corporate sustainability strategy aren’t just compliance requirements—they add value. Long-term financial planning and early diligence are becoming increasingly important, as future buyers and investors now factor in carbon fines and compliance risks when underwriting deals. Experts shared in their sessions that rather than relying on simple payback models, many investors are shifting toward exit-value-based funding for sustainability projects, seeking ESG initiatives that contribute directly to property value and investment returns.

#3: ADDRESSING GROWING DEMAND FOR ENERGY AND GRID RESILIENCE

The increasing power demands of data centers, building and vehicle electrification, and population growth are placing unprecedented strain on the energy grid. Experts at the forum noted that fossil fuels alone will not be able to support this growing demand, underscoring the urgent need for innovative energy solutions. Additionally, new tariffs on Canadian power imports could significantly impact U.S. states reliant on cross-border electricity, with potential cost increases of up to 25%.

#4: THE NEXT LEVEL OF BUILDING PERFORMANCE STANDARDS

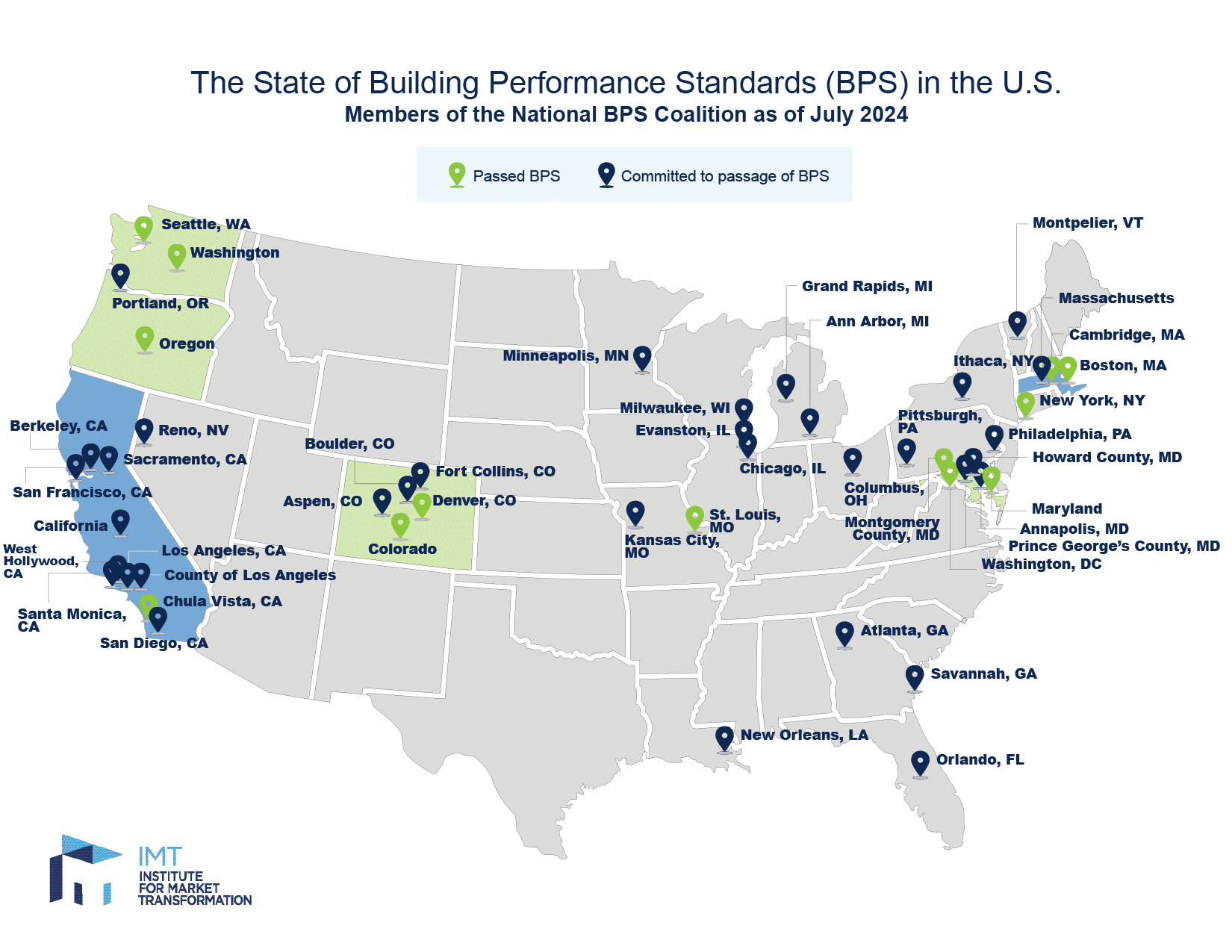

Building Performance Standards (BPS) are becoming an increasingly important regulatory tool. Currently, 13 jurisdictions have BPS in place, with more than 30 additional municipalities considering adoption. As federal policies shift, states are stepping up to set their own performance mandates. Organizations such as the Institute for Market Transformation (IMT) provide valuable resources, including an interactive map tracking both current and proposed BPS regulations.

#5: BIODIVERSITY AND NATURAL CAPITAL IN REAL ESTATE

Beyond energy efficiency, biodiversity and natural capital considerations are gaining traction in the industry. Within this sphere, trends include:

-

- Companies are integrating biodiversity strategies such as native landscaping, pesticide-free property management, stormwater mitigation, and light pollution reduction.

- Metrics like soil health and species monitoring are becoming key factors in real estate sustainability efforts.

- Financial incentives, including biodiversity tax credits, are beginning to emerge, further encouraging investment in nature-positive practices.

- Frameworks such as the Taskforce on Nature-related Financial Disclosures (TNFD) and the Science-Based Targets for Nature (SBTN) are helping quantify biodiversity risks and opportunities, making it easier for companies to integrate these considerations into their ESG strategies.

#6: LESSONS FROM EU SUSTAINABILITY REPORTING (CSRD)

While there’s still much to learn about the European Union’s Corporate Sustainability Reporting Directive (CSRD), real estate leaders already have some valuable guidance to set organizations up for success:

-

- The complexity and cost of compliance make early engagement with auditors essential to avoid misinterpretations of legislation.

- A focused approach—reporting only on material topics relevant to investors and shareholders rather than passion topics—proves more effective than trying to cover too broad a spectrum.

- Experts advised a conservative approach, starting with core metrics and expanding over time. Since ESG reports are increasingly integrated into financial statements, companies must be mindful that once a disclosure is made, it is difficult to retract.

The EU Commission is working on an Omnibus package with the goal to simplify sustainability reporting and better align the CSRD, Corporate Sustainability Due Diligence Directive (CSDDD), and EU Taxonomy. Despite the potential changes, the guidance above should still hold true.

The key takeaways from this year’s IMN ESG & Decarbonizing Real Estate Forum reinforce a crucial message: while the regulatory landscape may shift, the demand for sustainability in real estate is stronger than ever. Whether through tangible decarbonization measures, ESG-aligned financial strategies, energy resilience planning, or biodiversity initiatives, the industry is taking meaningful steps toward a more sustainable future. As these trends continue to evolve in 2025, real estate professionals must stay proactive, leveraging both emerging best practices and new policy developments to drive impactful change.

We’ll be at IMN’s ESG in Real Estate Summer Forum in Dana Point, CA this July – connect with our team and let’s continue the conversation there. In the meantime, want to discuss how your organization can stay ahead? Reach out to our team.