This blog post was co-authored by experts at Stok and Arcadis, two firms working to address climate risk across sectors.

Many organizations are heads-down preparing for near-term climate risk regulations (like California’s SB 261 deadline), but while compliance is a helpful catalyst, it’s only part of the picture. Work put into climate risk management now can unlock long-term business value if you take an integrated approach and keep the long-term view in mind.

Even if you’re early in your climate risk journey, understanding how lenders, owners, operators, and occupiers each think about and manage risk is essential for building a strategy that creates resilience and competitive advantage.

In this article, we’ll break down how organizations early in their climate risk journeys can turn climate risk awareness into climate risk management for long-term value.

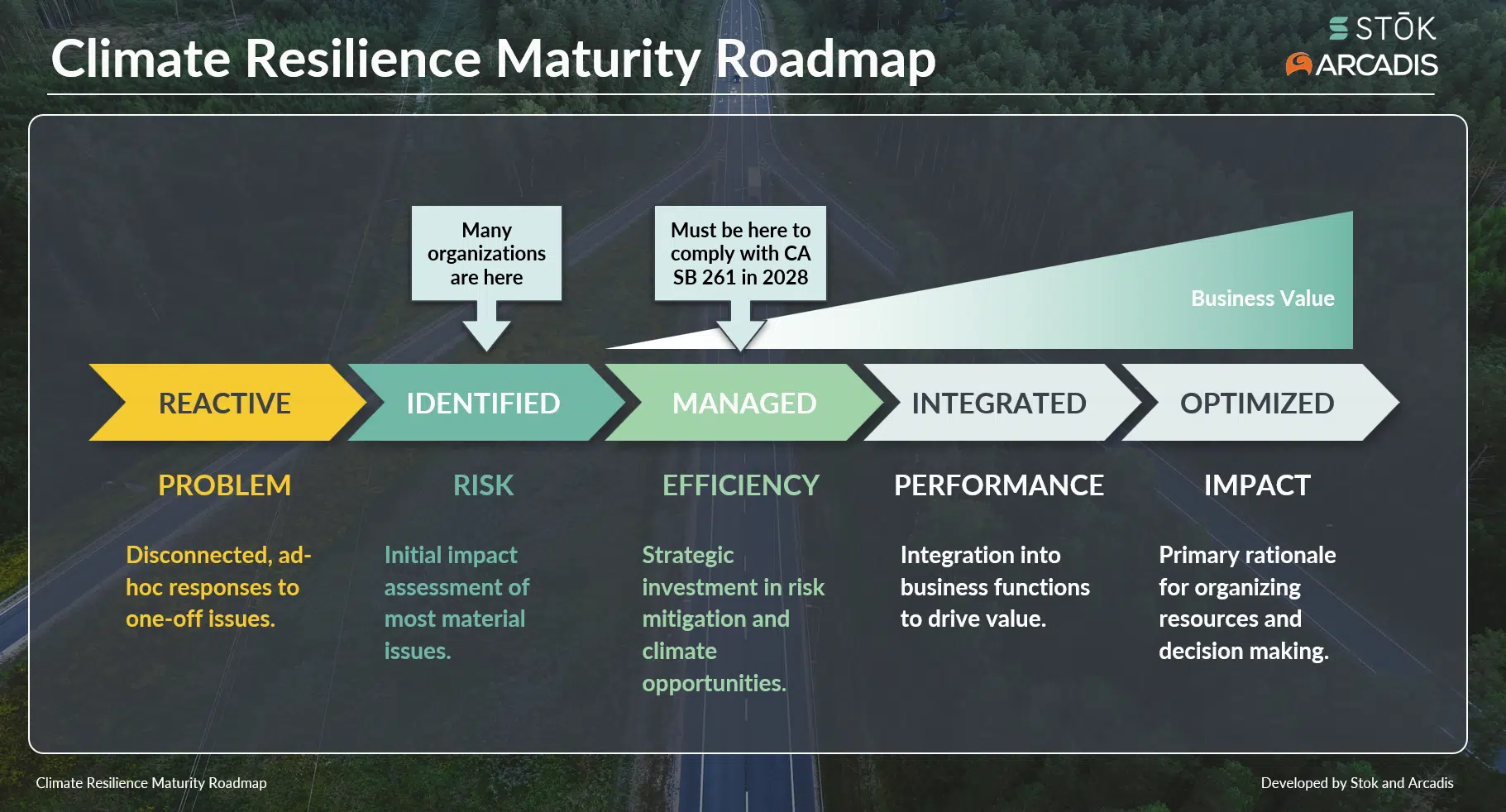

WHERE YOU SIT ON THE CLIMATE RESILIENCE MATURITY CURVE

We use a climate resilience maturity curve to help organizations understand where they are today in terms of their systems and processes for managing climate risk and what it takes to level up. Many organizations have efforts that span multiple stages, but most organizations can currently be categorized in the “Identified” stage.

If your organization’s in the Identified stage, you may recognize some familiar tensions:

-

-

- You’ve run exposure assessments but have not yet developed a solid and decision-useful financial accounting of climate risk that considers the vulnerability of individual assets.

- You have completed vulnerability assessments and GHG inventorying but aren’t yet using the findings to drive consistent decision-making.

- You’ve quantified the potential financial impacts of climate risk, but applying that data across the organization is still ad hoc.

- You’re beyond reactive, “one-off” responses, but not yet making strategic, coordinated investments in resilience.

-

You’ve got momentum and you know the risks. Now it’s time to operationalize them.

FROM IDENTIFYING THE CHALLENGE TO MANAGING IT

The shift from Identified to Managed is where climate risk stops being a standalone compliance or data-gathering exercise and becomes part of your enterprise risk program because climate is recognized as critical to business value and continuity. Identified is when you know what your risks are; Managed is when you’ve embedded processes to manage them consistently. This shift introduces ownership, metrics, and governance—the structures that really make climate resilience sustainable within your organization. You’ll start to assign roles, build accountability, and track progress through metrics that leaders care about.

To do this, you’ll meet with all key stakeholders to understand their performance drivers and how their part of the business defines success.

Here’s what to prioritize heading into next year:

-

-

- Develop a climate risk and resilience framework to regularly identify, assess, and manage operational risk. This institutionalizes risk management, making it part of financial and operational risk processes.

- Set measurable emissions reduction targets and track progress through key performance indicators (KPIs) tied to business performance. This aligns climate ambition with business performance, making progress trackable, comparable, and reportable.

- Establish executive sponsorship and empower cross-functional teams to act on climate priorities. This ensures leadership ownership of climate resilience and is when climate work becomes resourced.

- Centralize reliable data into an internal dashboard to help you make informed decisions as you write your climate resilience playbook.

- Strengthen supplier, design, and approval standards to extend resilience beyond your organization and build credibility.

- Pilot climate-aligned opportunities that unlock value or efficiency across your portfolio and demonstrate climate as an opportunity.

-

This stage usually requires more engagement from internal teams as opposed to third-party technical specialists performing discrete assessments. Consultants specializing in change management can act as strategic partners who deeply understand your business and stakeholders.

CLIMATE RISK MANAGEMENT IN ACTION

To see how these best practices translate into real progress, let’s look at a recent client example. One global technology client—a leader in decarbonization with a large, leased office portfolio—recognized that climate risk needed to play a bigger role in how they operated. They’d identified their risks but wanted a clearer path for where to focus first and how to embed climate resilience into everyday decisions across their global footprint.

They engaged Stok to support the journey, and together we built a practical approach: integrating a risk assessment tool into site evaluation, identifying priority sites, quantifying financial impacts, and developing a capital plan for resilience projects. Because of their commitment to strengthening resilience across the portfolio, climate risk is now part of their site selection, due diligence, and even lease language. Today, they’re operating within the Managed stage across most sites, with a clear roadmap for bringing their remaining sites along.

WHAT’S NEXT: BUILDING YOUR CLIMATE RISK MANAGEMENT DREAM TEAM

As organizations mature, climate risk becomes increasingly cross-functional. A simple RACI (Responsible, Accountable, Consulted, Informed) matrix can help you map who does what, where data lives, and how to build alignment across teams.

Download our RACI template and consider the following when filling yours out:

-

-

- Who’s already contributing to climate-related work? Think energy, asset valuation, leasing, tenant engagement, investor relations.

- What data do they already have? Even if it’s not labeled “climate risk data,” much of it is useful and can be leveraged to support climate risk management.

- How are they measured today? Understanding the KPIs of stakeholders across the business who are contributing to climate-related work (even if not in name) helps you frame climate risk in terms and metrics that resonate.

-

Your RACI becomes your roadmap for efficient conversations, clearer ownership, and faster progress as you seek to distribute and integrate climate risk management across the organization.

If your organization is in the Identified stage, you’re at an exciting point in your climate risk journey where you can start to turn compliance into competitive advantage. Download our RACI matrix template to start mapping your internal landscape and putting these best practices into action. And if you want a deeper dive into the full climate resilience maturity curve, watch Stok’s recorded webinar.

Reach out to discuss your RACI matrix and stay tuned for more insights on how organizations can continue to advance along the curve!

ABOUT THE AUTHORS

Colette Crouse, Director, Carbon Services, Stok

Colette leads Carbon Services for Stok and has over a decade of experience helping organizations develop and communicate their climate action programs. Colette has supported nonprofits, small businesses and Fortune 50s in establishing industry leading GHG accounting and data management practices, designing and operationalizing decarbonization strategies, and evolving internal expertise and programs to keep pace with changing standards and expectations. Colette also teaches Greenhouse Gas Accounting and Management at the University of Colorado, Boulder in the Masters of the Environment Program.

Kaylee Shalett, Global Technical Director, Climate Risk & Reporting, Arcadis

Kaylee is a climate resilience strategist with over a decade of experience helping companies turn climate risk into opportunity. As Global Technical Director for Climate Risk Assessments & Reporting at Arcadis, she has led 60+ cross-sector projects, supporting clients in embedding climate into enterprise risk management, creating decarbonization strategies that reduce risk and enhance cash flows, and aligning with IFRS S2 and emerging regulations. With a foundation in climate science and a focus on practical outcomes, Kaylee delivers data-driven, actionable strategies that build resilience and unlock long-term value.