Rising electricity prices and increasing volatility are hitting commercial real estate owners directly on the bottom line. Inefficient buildings are especially exposed, with operating costs escalating year over year.

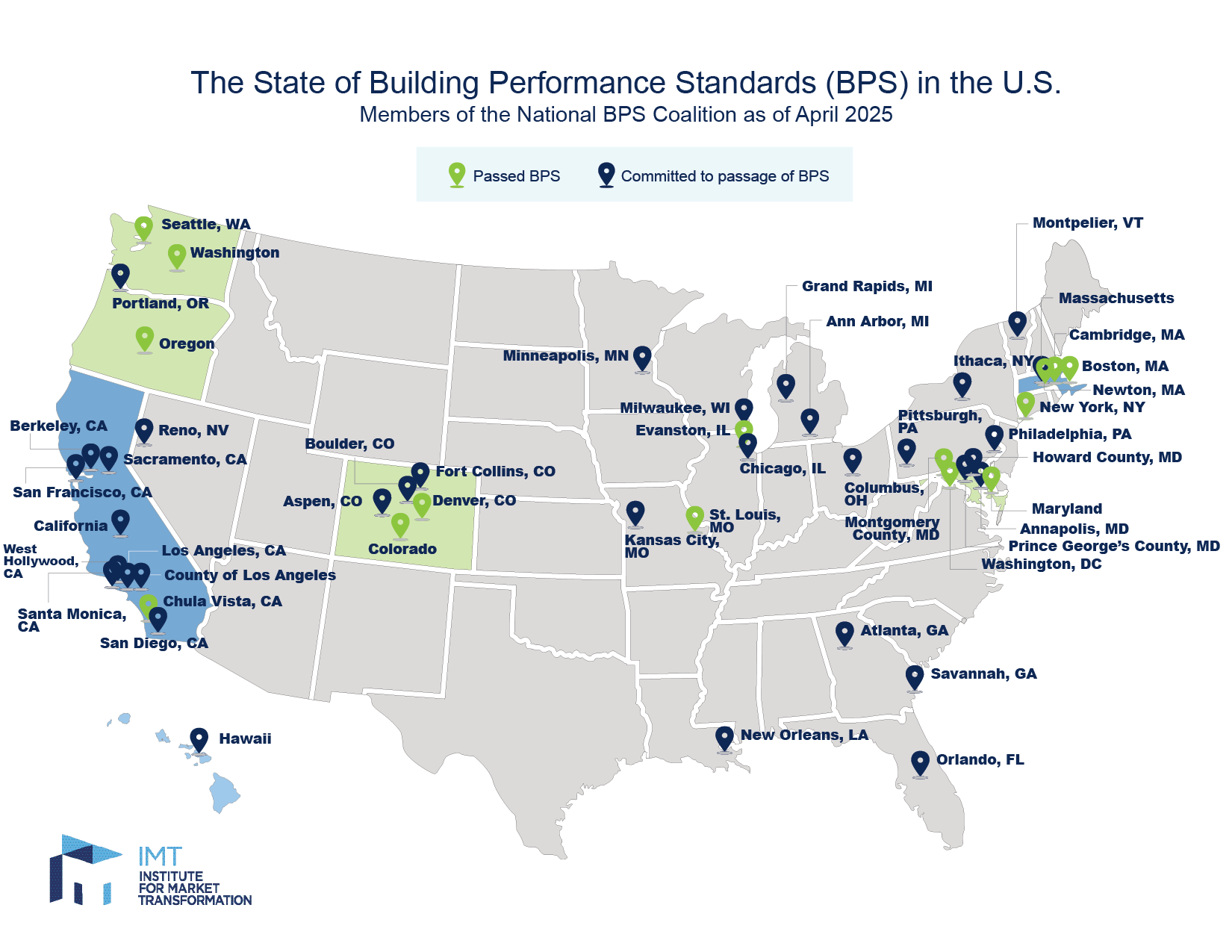

At the same time, building performance standards (BPS) are taking hold across the U.S. and Canada, bringing growing regulatory pressure alongside rising costs. If you own commercial real estate, BPS may soon impact your building’s value, operating cost, and compliance risk.

But focusing only on compliance misses the bigger picture. Inaction isn’t just a compliance risk—it’s a business risk. Acting strategically can protect value and reduce operating expenses while compliance comes as a byproduct.

WHAT ARE BUILDING PERFORMANCE STANDARDS (BPS) – AND WHY THEY MATTER NOW

While building codes set design standards for new construction and major renovations, building performance standards establish ongoing energy and carbon performance thresholds for existing buildings to drive efficiency and reduce emissions. These thresholds ratchet up over time, making today’s standards just the starting point.

There are currently 13 BPS policies across U.S. cities, covering nearly 25% of all U.S. buildings, as well as several across Canada. Most align with local climate action plans (CAPs) and cover new development as well as existing buildings. Reference the table below for key markets for Stok clients.

While mandatory benchmarking isn’t new, BPS takes things further. Benchmarking is a transparency tool focused on reporting, with fines that mainly enforce the act of disclosure. By contrast, BPS compels action, requiring buildings to meet performance thresholds, with penalties often tied to either building size (dollars per square foot) or excess emissions (dollars per ton of GHG above the target). These penalties are designed to drive retrofits and major upgrades. Owners with strong energy, water, and data management systems are already positioned for success. Those without them will need to act quickly to avoid financial and reputational losses.

RISK TO YOUR PORTFOLIO

BPS creates both financial and reputational risks that can erode value and market position if left unaddressed. The longer owners wait, the higher the cost of action may become.

#1: Financial risk

-

- Rising and volatile utility costs: Inefficient buildings face higher exposure to energy price volatility and utility escalation, eroding operating margins.

-

- Escalating non-compliance penalties: Recurring fines tied to building-level performance metrics (e.g., emissions caps, energy intensity) add up quickly, compounding costs if compliance is deferred.

-

- Owner accountability: Legal responsibility for performance rests with owners, even when tenants drive consumption, unless mitigated through green leases or sub-metering.

-

- Compounding cost of inaction: Deferring compliance drives up expenses through mounting penalties, inflation in retrofit costs, limited contractor and equipment availability, and shrinking access to incentives.

-

- Capital planning pressure: Deep retrofits often require multi-year planning and financing; owners who wait risk rushed, reactive spending with weaker ROI and potential tenant disruption.

#2: Reputational risk

-

- Asset devaluation: Non-compliant properties face declining valuations, higher cap rates, and the potential to become stranded assets as demand consolidates around compliant, efficient buildings.

-

- Public visibility: Benchmarking disclosures and published energy grades increasingly shape tenant decisions, investor confidence, and media narratives.

-

- Investor and lender scrutiny: BPS compliance and carbon liabilities are increasingly showing up in underwriting, debt covenants, and acquisition due diligence.

-

- ESG requirements: What were once voluntary ESG and decarbonization goals are evolving into non-negotiable requirements for institutional investors, REITs, and corporate tenants.

-

- Tenant attraction and retention: Poor performance and reputational concerns undermine tenant satisfaction and renewal rates, while proactive owners can command premium rents and win high-credit tenants.

The good news: wherever you are on the journey, whether just getting started or building on existing efforts, there are clear, practical steps to turn these risks into opportunities for stronger, more resilient portfolios.

5 THINGS CRE OWNERS CAN DO RIGHT NOW

#1: Map BPS exposure across your portfolio

If you own or operate buildings in multiple geographies, tracking evolving codes and staying proactive is a resource-intensive challenge. A BPS impact analysis identifies risks across your portfolio to assess where you’re regulated now (or soon will be).

Some of the most common BPS policies that impact our clients’ portfolios are outlined in the table below.

| Jurisdiction | Year first BPS fines are in effect | Reporting cycle length* |

|---|---|---|

| Washington, D.C. | 2023 | 5 years |

| New York City (LL97) | 2024 | 1 year |

| Boston (BERDO) | 2025 | 5 years |

| St. Louis, MO | 2025 | 4 years |

| State of Washington | 2026 | 5 years |

| State of Colorado | 2026 | 4 years |

| Montgomery County, MD | 2027 | 5 years |

| State of Oregon | 2028 | 5 years |

| Energize Denver | 2030 | TBD |

| Seattle, WA | 2031 | 5 years |

*Reporting cycle length for BPS is the interval at which building owners must submit performance data to demonstrate compliance.

#2: Quantify the gap

Compare current building performance with BPS thresholds to understand exposure, compliance risk, and cost impact.

#3: Integrate BPS into capital planning

Factor electrification, HVAC, and envelope upgrades into CapEx planning, for example, by mapping out retrofit costs against potential fines for noncompliance. Align retrofit timing with lease cycles and renovations to minimize disruption while maximizing ROI.

#4: Centralize data and governance

Establish accurate, accessible portfolio-wide energy and emissions data. Leverage centralized data platforms to simplify tracking, support disclosure requirements, and enable strategic decision-making. ENERGY STAR® Portfolio Manager is a popular option, though it may be phased out soon.

#5: Leverage incentives while they’re available

Tap into utility programs, C-PACE, and federal tax credits (while they last) to fund upgrades. Many programs can shift or sunset quickly (like the IRA), so capturing them now lowers costs and accelerates ROI.

COMPLIANCE ISN’T THE GOAL, VALUE CREATION IS

Building performance standards are unavoidable. The real choice for CRE owners is whether compliance becomes a cost burden—or a catalyst for business value.

-

- First movers protect asset value, secure incentives, and build competitive edge.

-

- Buildings that outperform BPS thresholds shift from regulatory liabilities to market-leading assets.

-

- Forward-looking portfolios already price carbon risk into strategy; those who wait face rising costs and stranded assets.

-

- Acting now mitigates volatility in energy pricing, reduces long-term operating expenses, and drives toward decarbonization goals.

Bottom line: BPS can be more than a compliance exercise; they’re a springboard for opportunity. CRE owners who act strategically will shape the next era of profitable, resilient real estate. Those who delay risk higher costs, regulatory penalties, and declining asset value.

Ready to understand how BPS will impact your portfolio and what you can do about it? Connect with our team to build your strategy.

And stay tuned for Part 2: How to build an action plan for your portfolio that prioritizes assets based on compliance risk, cost exposure, and your broader asset strategy.