Across corporate environmental, social, and governance (ESG) efforts, climate action remains a top priority. As just one example, take the European Sustainability Reporting Standards (ESRS), which took effect in 2025. Of the 10 ESG topics covered by the standards, only one—climate change—is required.

While many of the carbon trends we highlighted in 2024 are just as relevant now, 2025 holds new focus. Regulation remains top of mind and yet for many companies, it offers a supporting—not a primary—driver for the accounting, decarbonization, and risk management efforts already in progress. Alongside embodied carbon, the need for better data, and interest in the carbon market, these trends and many more are paving the path for what we expect to be another busy, if not frenetic, year in climate action. Let’s dive in.

#1: CORPORATE CLIMATE REGULATION IS ON THE RISE

The global trend toward increasing climate disclosure is clear. While a shift away from climate regulation by the U.S. Federal Government will contribute to broader market uncertainty, we still believe that last year’s prediction that greenhouse gas (GHG) accounting would shift from a voluntary to a compliance mindset came true. Even in the absence of action from the SEC, U.S.-based companies are facing regulatory pressure and/or uncertainty sufficient to motivate a quick move toward disclosure readiness. As we like to say, the best time to start preparing was years ago. And the next best time to start is now.

Many public and private companies will be subject to near-term disclosure deadlines through California’s Climate Accountability Package and may already be subject to the European Sustainability Reporting Standards (ESRS), which took effect for the first wave of companies in 2025. In December, the Canadian Sustainability Standards Board (CSSB) published final sustainability and climate-related disclosures (CSDSs) that, consistent with California and the EU, broadly align with IFRS1 and IFRS2. While Canada’s disclosures are initially voluntary, they are expected to become mandatory in the future and enforced by the Canadian Securities Administrators (CSA), Canada’s SEC-equivalent.

#2: BUILDING PERFORMANCE STANDARDS EXPAND

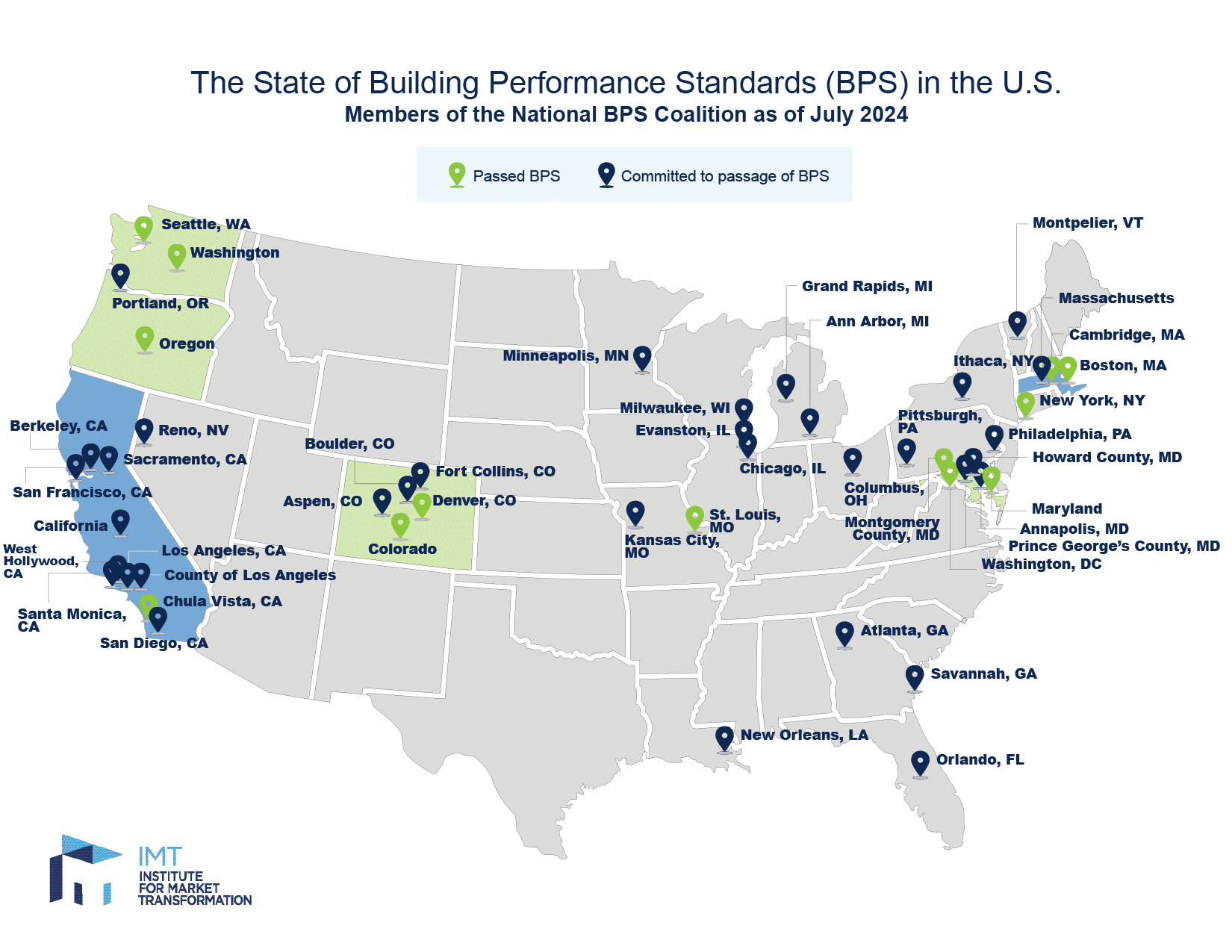

Paralleling evolution in corporate climate disclosure is the continued scaling and stringency of local building performance standards (BPS) focused on energy and GHG performance. Across U.S. cities there are now 13 BPSs (accounting for nearly 25% of all U.S. buildings), most of which align with local climate action plans (CAPs) and cover new development as well as existing buildings. For organizations with portfolios spanning multiple geographies, tracking evolving codes and staying proactive is a resource-intensive challenge.

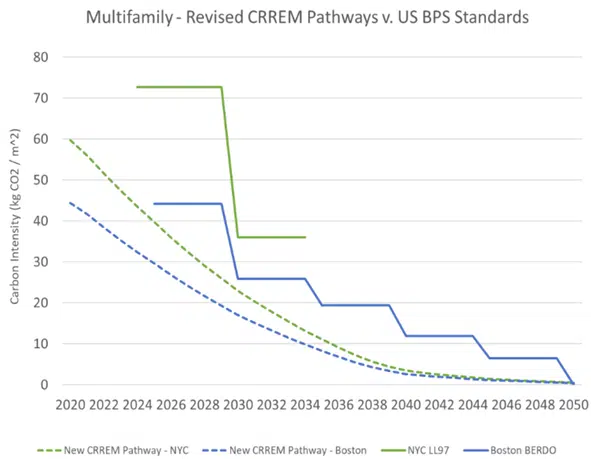

Organizations looking to set emissions reduction targets and/or define or update portfolio decarbonization plans will want to develop targets and plans that are consistent with local codes. In 2025, the Urban Land Institute (ULI), Carbon Risk Real Estate Monitor (CRREM), and Lawrence Berkeley National Lab (LBNL) released climate science-aligned, North American decarbonization pathways for geographies in the U.S. and Canada. These pathways are also the backbone of the Science Based Targets Initiative (SBTi)’s new target-setting criteria for the Buildings Sector, finalized in 2025. As part of the project, ULI and CRREM completed a review of current and emerging BPSs and compared decarbonization pathway outputs to adopted BPSs. Leveraging the new North American decarbonization pathways from the get-go will help organizations meet BPSs across their portfolio rather than play whack-a-mole across specific jurisdictions.

#3: EMBODIED CARBON TAKES CENTER STAGE

We expect to see a heightened focus in 2025 on collecting actual embodied carbon data and decarbonizing upstream emissions. California’s Carbon Intensity of Construction and Building Materials Act, which aims to reduce embodied carbon emissions by 40% from baseline by 2035, is ramping up, with a framework from the California Air Resources Board (CARB) expected halfway through 2025. Many other states and cities, such as Vancouver and New York, are forging ahead with the same or similar goals, focusing on expanding the availability of environmental product declarations (EPDs), enforcing global warming potential (GWP) thresholds for specific materials, and/or legislating intensity or reduction thresholds for new development projects.

Additional momentum comes from the latest version of LEED, LEEDv5, which places a higher value on decarbonization and to this end, has transitioned many optional credits to prerequisites. For example, projects are now required to quantify the embodied carbon of the structure, enclosure, and hardscape materials to attain certification. In addition, projects must describe which strategies they have pursued to address the top three sources of embodied carbon. Points awarded for conducting a whole building life-cycle assessment (WBLCA) are planned to increase to up to 8 points under LEED v5.

For organizations that haven’t yet moved meaningfully on embodied carbon, 2025 is the year to do so.

#4: DATA CREDIBILITY IS KEY

This trend is back by popular demand! With continued rollout of regulatory disclosures focused on greenhouse gas emissions and climate risk, we expect (and hope!) to see data management and improvement prioritized in 2025, particularly for organizations early on in their GHG journeys. We’ve already begun to see a higher value placed on auditable documentation, including underlying activity datasets and standard operating procedures such as an Inventory Management Plan (IMP). As in 2024, we expect to see more first-time GHG inventories, increased involvement of internal auditing departments, additional resources allocated to enhancing data coverage and quality, and undertaking of external third-party assurance.

#5: CARBON MARKETS MATURE

Last year we expected to see corporate buyers shy away from the voluntary carbon market (VCM) due to negative media coverage and concerns over quality. Thankfully, the market instead experienced modest growth over 2023. The number and value of offtake agreements in 2024 dwarfed 2023 across both nature- and technology-based solutions. Admittedly, this is largely driven by advanced market commitments from corporate purchasing coalitions such as Frontier Buyers Club and Symbiosis, not by average purchasers.

Investment in carbon dioxide removal (CDR) is growing rapidly, with demand for high-durability CDR credits extending beyond supply, at least for those who can afford to pay for it while prices remain high. Meanwhile, significant federal legislation and funding across several jurisdictions, including the U.S., Canada, UK, and Denmark, are working to create the supports and demand necessary to lower investment risk and scale critical carbon removal solutions.

Efforts to improve market trust in the VCM continue as we anticipate more Integrity Council for the Voluntary Carbon Market (ICVCM) Core Carbon Principle (CCP)-eligible programs and credits to become available in 2025. While the CCP label is more of a floor than a ceiling for high quality credits, we believe it remains a valuable step forward in the market and provides at least some assurance to buyers who may not have the time or resources to engage in bespoke purchasing approaches. For organizations with current science-aligned targets and/or those looking to set them soon, keep an eye out for the SBTi’s Corporate Net-Zero Standard 2.0 draft, expected Q1 2025 and anticipated to include requirements around near-term carbon removal.

For more on carbon credits and the VCM more broadly, see Stok’s Carbon Credits FAQ Part 1 and 2.

Among these annual trends, the theme remains: momentum behind disclosure transparency and decarbonization is growing. From GHG inventories and whole-building LCAs, to regulatory compliance, corporate strategy, and decarbonization planning, Stok’s carbon experts are here to support at any stage in your organization’s climate journey. Reach out to talk to our team.